Steering the Intricate Financial Landscape of Elderly Care Choices

Steering the Intricate Financial Landscape of Elderly Care Choices

Blog Article

Maneuvering the monetary terrain of senior care choices can be a difficult endeavor for families and persons. As individuals age, their needs often evolve, requiring various types of support and assistance. Understanding the different choices available, along with their associated costs, is crucial for making informed choices. This piece will explore the various types of elderly care, the monetary implications of each choice, and strategies for handling these expenses effectively.

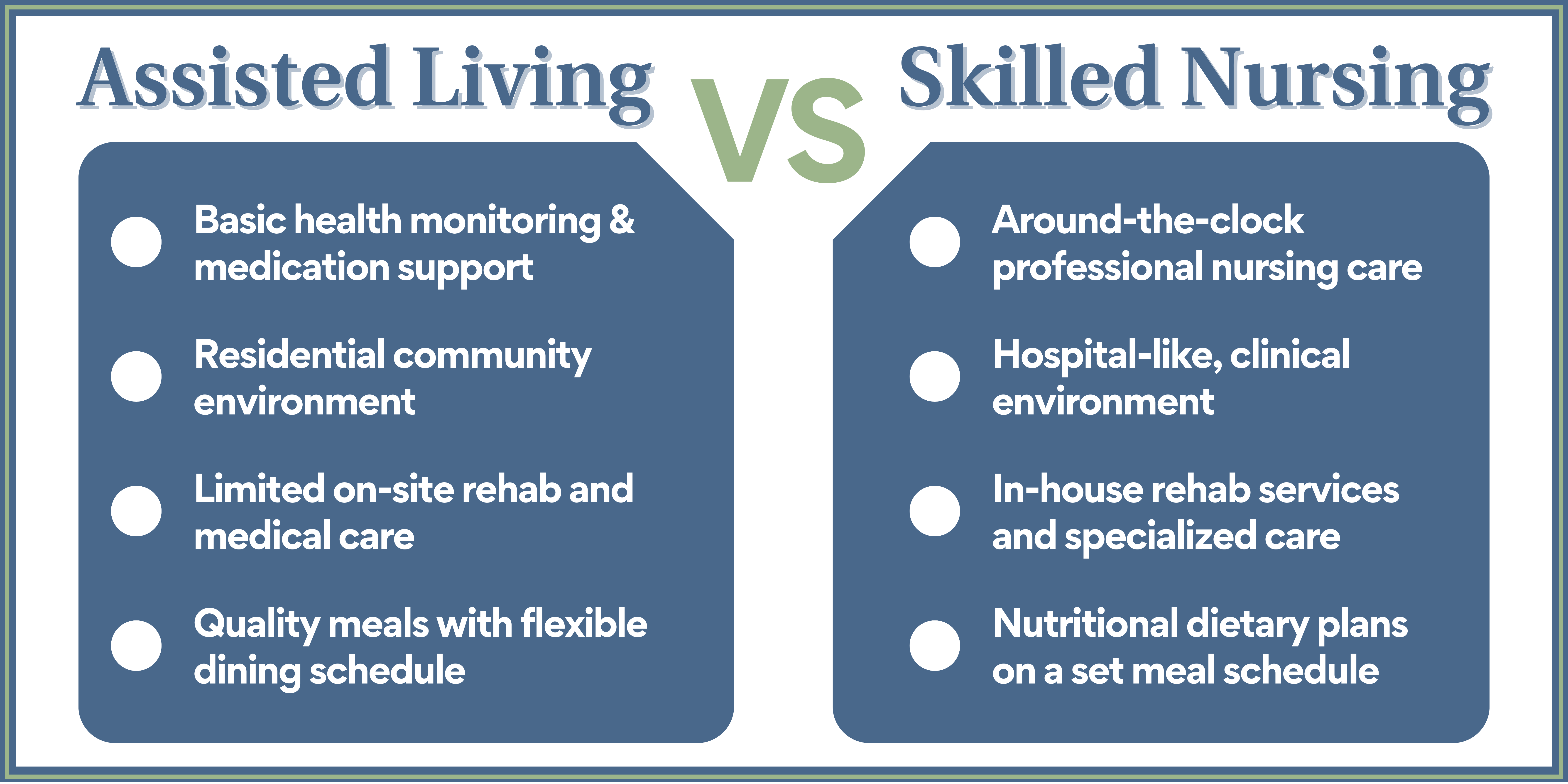

There are several types of elderly care choices available, each catering to different needs. Home care solutions allow seniors to receive assistance in their personal homes, which can encompass help with daily tasks such as hygiene, cooking, and pharmaceutical management. Assisted living communities provide a more communal living setting, offering assistance with everyday tasks while allowing residents to keep a level of self-sufficiency. For those with more complex medical requirements, skilled nursing facilities offer extensive care, including 24-hour medical oversight. Understanding these choices is crucial for families to determine what type of assistance best fits their family members.

The costs associated with senior assistance can differ significantly based on the type of service selected. In-home care services may bill per hour rates, which can add up rapidly depending site on the amount of hours needed each week. Supportive living communities typically have monthly fees that include housing, meals, and fundamental assistance services. Nursing homes often have elevated costs due to the comprehensive healthcare care provided. It is crucial for relatives to research and contrast costs, as well as to consider any additional charges that may not be included in the starting cost.

Financing senior assistance can be a complicated process, but there are several choices available to help handle these costs. Many families rely on individual savings or income from retirement accounts to cover costs. Extended assistance insurance is another choice that can offer financial assistance for different types of senior assistance. Additionally, state programs such as Medicaid may provide support for those who qualify based on income and necessity. Understanding these financial options can help families make more knowledgeable decisions about their assistance choices.

Planning for elderly care should start in advance, as this can help reduce some of the monetary stress down the line. Families are encouraged to have honest conversations about care choices and financial abilities. Establishing a financial plan that outlines potential expenses and accessible resources can also be helpful. By taking preemptive steps, families can more effectively navigate the complicated financial terrain of senior assistance options, guaranteeing that their loved ones receive the care they require while managing costs effectively.